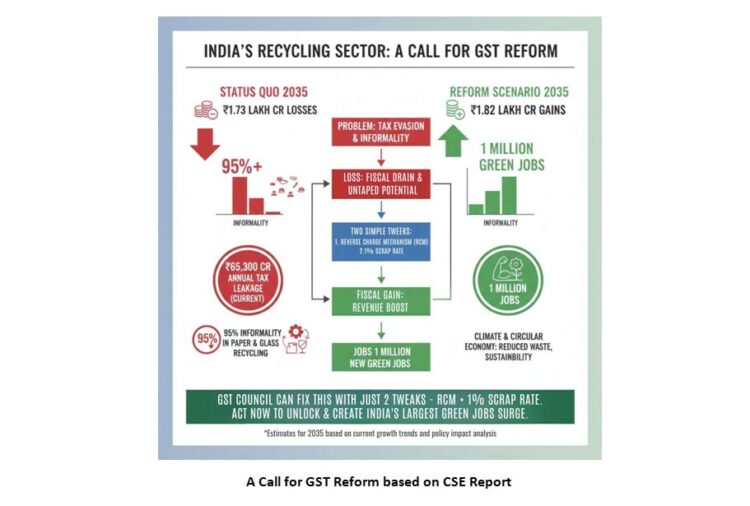

NEW DELHI, October 01, 2025: India’s recycling sector faces a critical fiscal crisis: the government currently collects ₹30,900 crore from formal recycling but loses ₹65,300 crore annually to informality-driven tax leakages double the revenue collected. By 2035, under status quo, collections may reach ₹86.7K crore but losses could escalate to ₹1.82 lakh crore, resulting in a net negative of ₹86.7K crore.

According to the Centre for Science and Environment’s (CSE) 2025 report titled “Relax the Tax” (https://www.cseindia.org/relax-the-tax-12819), two targeted GST reforms could flip this loss into a net positive of ₹1.82 lakh crore through full formalization with a 12% rate transforming India’s ₹5 lakh crore recycling economy.

The Compliance Paradox: Legitimate Businesses Pay for Others’ Fraud

“You pay your taxes, you check the documents, and still a notice arrives years later,” one Delhi recycler says. “How do you plan expansion with that risk?”

In a workshop on the outskirts of Jaipur, a young entrepreneur runs a modest paper recycling unit with ten employees. Every ton of wastepaper he processes reduces landfill load and saves trees. But when asked why he hasn’t scaled further, his answer is blunt: “The tax rules make my business risky.”

This is a story shared by many micro, small and medium enterprises (MSMEs) in India’s recycling sector. Whether in plastics, metals, paper, or e-waste, entrepreneurs say they follow GST rules yet are penalized when upstream dealers vanish or fail to deposit tax. For a small business, one disputed notice can wipe out working capital.

Recyclers follow all the formal processes: sourcing from GST-registered suppliers, maintaining e-way bills, and making payments through official channels. Still, when upstream suppliers fail to remit GST, the last visible recycler becomes liable, facing penalties, interest, and unexpected tax reversals. Even relatively small infractions can freeze working capital for months, stalling expansion and discouraging reinvestment in infrastructure.

“We follow the rules, pay our dues, and still end up paying for fraud committed by others in the supply chain,” says one recycler in Delhi.

In some cases, companies have reported ITC reversals that turn ₹1 crore worth of tax credits into a ₹2.5 crore liability after penalties and interest are applied.

Where the ‘Tax Pipe’ Leaks: The Informality Crisis

The CSE report confirms this reality: informality dominates the very chains these entrepreneurs depend on approximately 95% in paper & glass, 80% in plastics, 90% in e-waste, and 65% in metals. These are precisely the streams where tax leakages occur.

With scrap taxed at 18%, the same as many finished goods, that spread makes paper-only trades attractive higher up the chain, and pushes compliance risk toward the last visible, solvent entity the recycler. The result is volatile working capital, higher risk premia, and delayed approvals.

Much of India’s plastic and other scrap originates in the unorganized chain: ragpickers → small dealers → medium aggregators → big dealer. GST typically enters only at the last leg, when a major dealer invoices a recycler. With scrap taxed at 18%, fake invoicing and paper-only trades become attractive.

The Two-Reform Solution

Industry and policy experts point to two levers that, together or separately, could change the investment equation:

- Reverse Charge Mechanism (RCM) for Scrap

Make the recycler, not the middleman, pay GST directly to government, cutting out fake invoices. Liability shifts to the documented buyer the recycler who pays GST directly to the exchequer. This starves “paper-only” dealer chains and anchors collection where there is audit trail.

- Lower GST Rate on Scrap (approximately 1%)

Keeps finished goods at 18% but removes the arbitrage that drives fraud. Shrinking that spread reduces the payoff from fake billing without touching tax at value-add. Bringing down the GST rate on plastics, metals, paper, and e-waste to around 1% would make recycling financially viable, enabling entrepreneurs to invest in better technology, scale their operations, and reduce dependence on informal channels.

Some representations also flag exemption for scrap as an option, though this is considered controversial.

The Fiscal Revolution: CSE’s Scenario Modeling

CSE’s scenario modeling finds that every reform pathway flips losses into gains. The strongest case full formalization with a 12% rate yields an estimated net positive of ₹1.82 lakh crore.

The fiscal stakes are material. CSE estimates that today formal recycling brings in ₹30,900 crore of GST, while leakages tied to informality are ₹65,300 crore. On a status-quo path to 2035, collections rise to ₹86,700 crore but losses escalate to ₹1.73 lakh crore net negative ₹86,700 crore.

What Steadier Cash Unlocks

A clearer line of sight on tax and credits typically lowers underwriting friction for:

- Plastics: Higher-throughput hot-wash, NIR sorting and de-odor units that lift resin quality

- Paper: Pulping and fiber-recovery upgrades to meet recycled-content targets

- Metals: Compact shears/shredders, sensor-based sorting to improve yield and alloy integrity

Ask lenders why projects for hot-wash and NIR sorting lines (plastics), fiber-recovery upgrades (paper) or compact shredders with alloy sorting (metals) often stall, and the answer is the same cash flows look unpredictable when legitimate buyers can be hit with legacy liabilities for someone else’s non-compliance.

Beyond Revenue: Green Jobs and Economic Impact

The benefits of GST reform go beyond individual businesses. A formalized recycling sector could generate tens of thousands of green jobs across collection, processing, and logistics. Municipalities would see improved waste segregation, less landfill burden, and more efficient material recovery. This, in turn, could stimulate local economies and enhance the viability of sustainable business models.

According to industry estimates, these reforms could create up to 1 million jobs within the recycling sector over the next decade, particularly in sectors like plastic sorting, metal recovery, and paper recycling.

Moreover, a strengthened recycling sector contributes directly to India’s climate goals. By keeping plastics, metals, and paper in circulation, recyclers reduce the demand for virgin materials, lower carbon emissions, and foster a circular economy that can scale nationally.

The CSE Roadmap: Beyond Tax Reform

Beyond the headline rate, CSE flags operational frictions that keep cash uneven: C2B flows left out of the net, misclassification, refund friction, and rate mismatches that strand credits.

The report also recommends:

- Linking GST benefits to verified EPR flows: Ensuring that tax benefits track real material movement, not just paper trails

- Establishing Common Facility Centers (CFCs): So MSME recyclers can upgrade quality and compliance

- City-level transition plans: To map informal chains and create formalization pathways

- Worker recognition and social protection: For ragpickers and waste collectors

The Wider Impact

Smarter GST rules don’t just ease compliance for recyclers; they make India’s green economy more resilient. With stable cash flows, recyclers can scale plastic sorting, fiber recovery in paper mills, and safe e-waste dismantling. Cities benefit from reduced landfill load, and workers gain recognition and protection as the system formalizes.

When scrap is trapped in informal chains, cities face overflowing landfills, while ragpickers get squeezed on price. When GST flows are predictable, formal recyclers can invest in better processing, creating safer jobs and cleaner neighborhoods.

Industry Call to Action

India’s recycling industry, represented by leading associations, is urging policymakers to consider these reforms as part of India’s broader green economy strategy. The recommendations from the CSE report provide a clear roadmap for:

- Implementing RCM for scrap materials to ensure tax collection at the point of accountability

- Reducing GST rates on scrap to eliminate arbitrage opportunities that fuel fraud

- Establishing infrastructure support through CFCs for MSME recyclers

- Integrating EPR compliance with GST incentives

The Bottom Line

Smarter GST rules can help India recover more, waste less, and bring the green economy into the mainstream. Prevention is better than punishment. Collect tax where accountability is strongest, narrow the spread that invites fraud, and build a system where compliance pays.

Recycling is a capex story hiding inside a tax story. Stabilize cash, and projects move from pilot to plant. With RCM and a lower scrap rate, plus practical enablers like EPR-GST alignment and CFCs, India can crowd in private capital led by plastics and paper, with metals in the mix without diluting tax at the point of value creation.

The time has come for policymakers to recognize recycling as a strategic sector for India’s green economy. Implementing reforms such as RCM, lower rates, and targeted exemptions can unlock billions in economic value, create green jobs, and accelerate the country’s transition to a sustainable, circular economy.

REFERENCE:

Centre for Science and Environment (CSE) Report: “Relax the Tax” (2025)

Full report available at: https://www.cseindia.org/relax-the-tax-12819